The smart Trick of Estate Planning Attorney That Nobody is Discussing

The smart Trick of Estate Planning Attorney That Nobody is Discussing

Blog Article

The smart Trick of Estate Planning Attorney That Nobody is Discussing

Table of ContentsEstate Planning Attorney Can Be Fun For EveryoneExcitement About Estate Planning AttorneyAll About Estate Planning AttorneyThe Main Principles Of Estate Planning Attorney

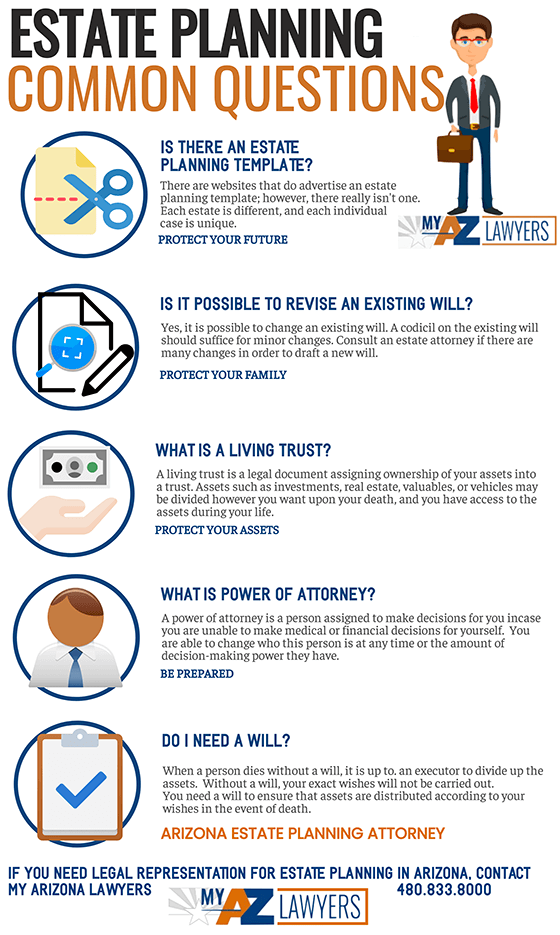

Estate preparation is an activity plan you can make use of to establish what occurs to your properties and obligations while you're to life and after you pass away. A will, on the various other hand, is a legal file that lays out how assets are distributed, that deals with children and animals, and any kind of various other wishes after you die.

Cases that are declined by the administrator can be taken to court where a probate court will have the last say as to whether or not the case is valid.

The smart Trick of Estate Planning Attorney That Nobody is Talking About

After the stock of the estate has actually been taken, the worth of properties computed, and taxes and debt paid off, the executor will after that look for consent from the court to disperse whatever is left of the estate to the recipients. Any kind of inheritance tax that are pending will certainly come due within 9 months of the day of fatality.

Each individual places their assets in the count on and names somebody other than their spouse as the beneficiary., to support grandchildrens' education and learning.

Estate Planning Attorney Fundamentals Explained

Estate coordinators can work with the donor in order to lower gross income as an outcome of those payments or formulate strategies that make the most of the effect of those contributions. This is one more strategy that can be utilized to limit fatality taxes. It involves a Find Out More specific securing the existing value, and thus tax obligation liability, of their residential or commercial property, while connecting the value of future development of that funding to another person. This approach includes cold the value of a property at its value on the day of transfer. Appropriately, the quantity of prospective resources gain at death is additionally frozen, permitting the estate coordinator to approximate their potential tax obligation liability upon fatality and better plan for the settlement of income tax obligations.

If sufficient insurance coverage proceeds are offered and the plans are correctly structured, any kind of income tax on the regarded dispositions of possessions adhering to the fatality of an individual can be paid without turning to the sale of properties. Proceeds from life insurance policy that are obtained by the beneficiaries upon the death of the guaranteed are usually income tax-free.

There are particular documents you'll require as component of the estate preparation procedure. Some of the most usual ones consist of wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a misconception that estate preparation is just for high-net-worth people. Estate planning makes it much easier for individuals to identify their wishes before and after they pass away.

Our Estate Planning Attorney PDFs

You need to start browse around these guys planning for your estate as quickly as you have any quantifiable possession base. It's an ongoing procedure: as life progresses, your estate strategy ought to change to match your scenarios, in line with your brand-new goals. And maintain at it. Refraining from doing your estate preparation can trigger excessive monetary burdens to enjoyed ones.

Estate preparation is frequently considered a tool for the affluent. That isn't the instance. It can be a useful method for you to manage your assets and responsibilities prior to and after you view it die. Estate preparation is additionally a terrific means for you to lay out prepare for the treatment of your small children and animals and to describe your want your funeral and preferred charities.

Eligible applicants that pass the exam will be formally certified in August. If you're qualified to rest for the exam from a previous application, you might submit the short application.

Report this page